Fast, Secure, and

Compliant Identity Checks

Verify users quickly and securely with our robust KYC solutions. Our seamless verification process helps you reduce fraud, meet regulatory compliance, and build trust with every onboarding. Ensure a smooth and secure experience for your customers while protecting your business from risks.

The Skaletek KYC Workflow

Stay compliant and in control with automated screening across global watchlists, PEPs, adverse media, and ongoing monitoring. Our AI-driven engine delivers accurate, always-on insights—so you can onboard faster, reduce risk, and meet regulatory demands with confidence.

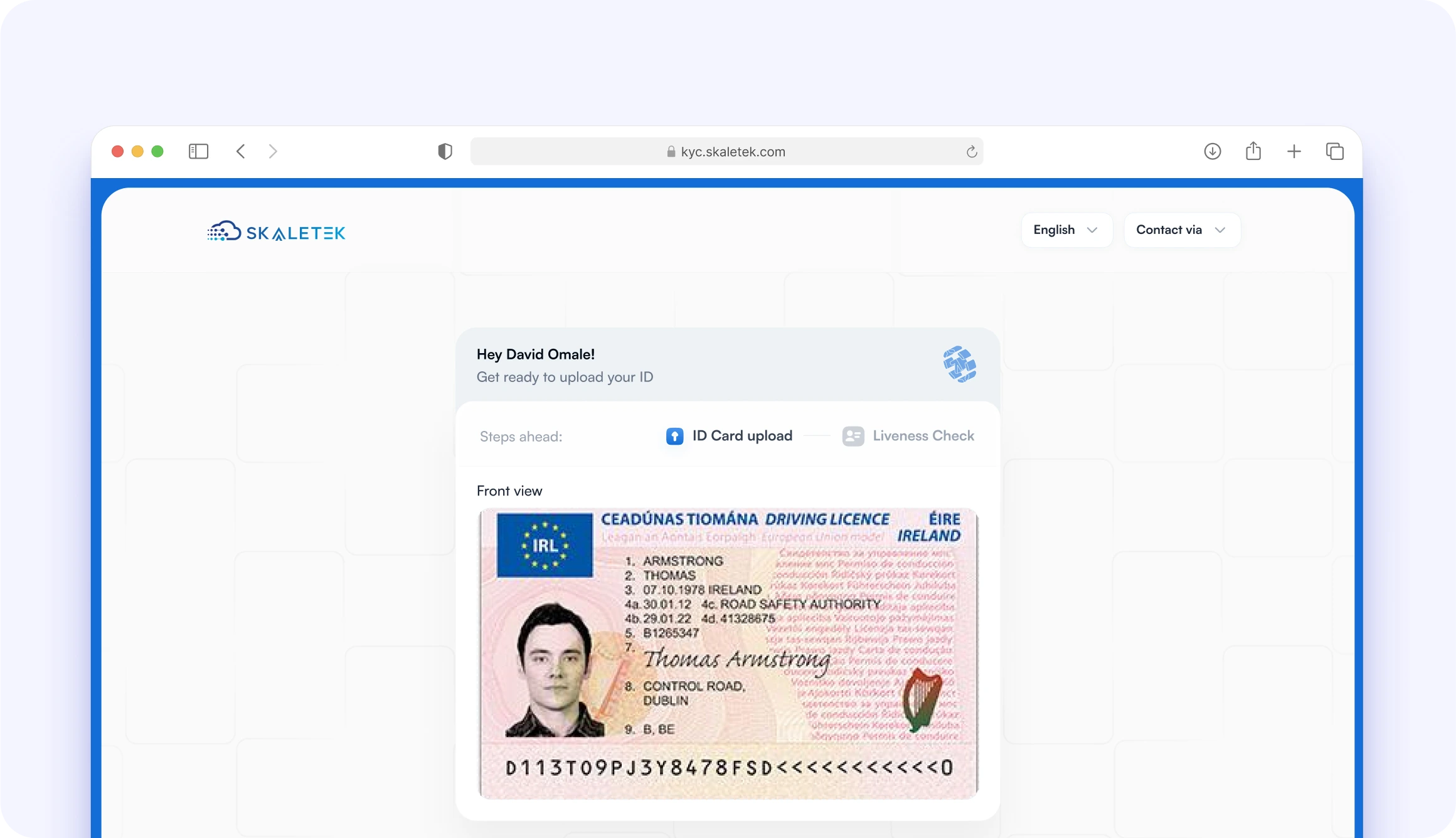

Step 1: Read & Extract data

Automatically read and parse identity documents to capture key personal information with precision.

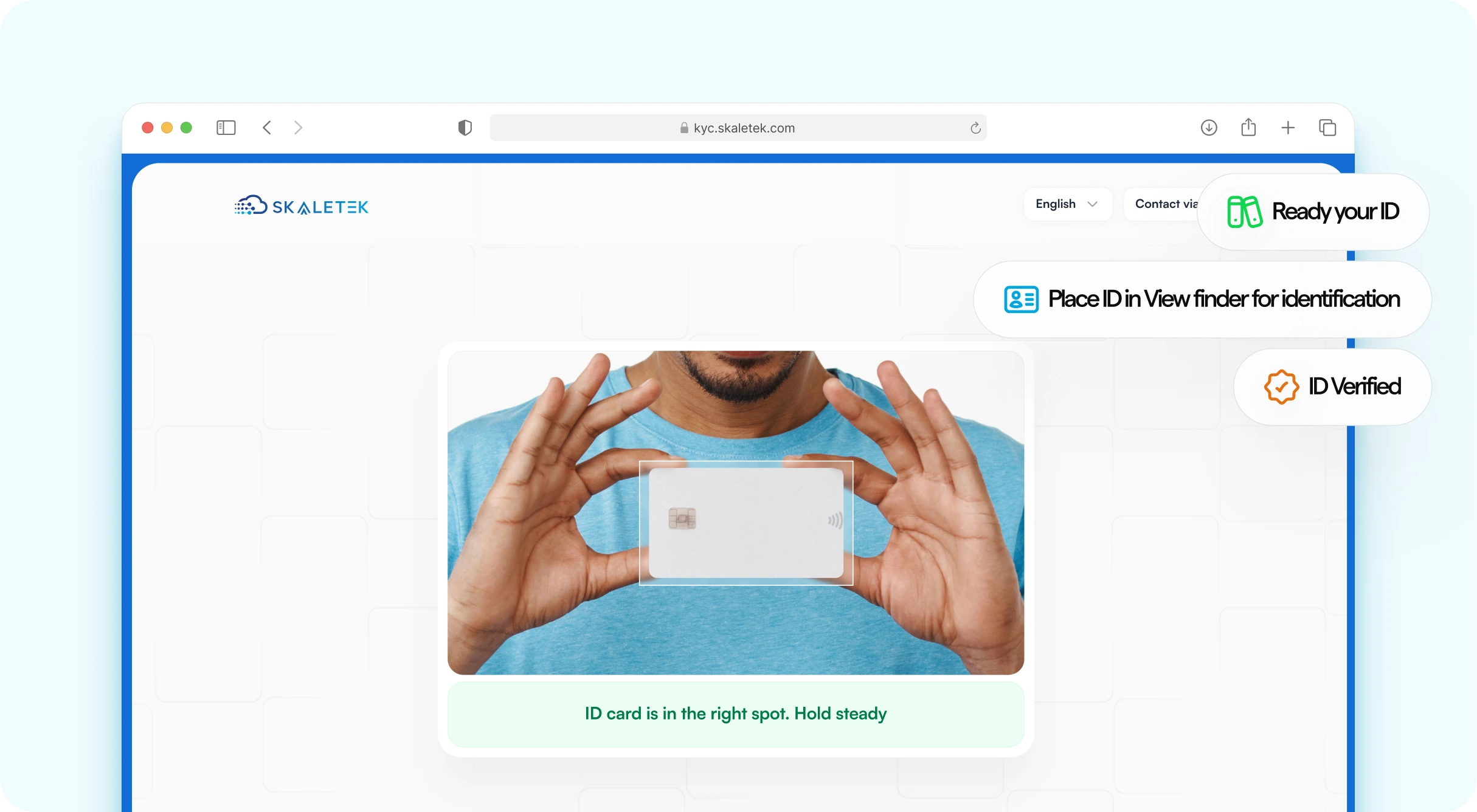

Step 2: Check Authenticity

Verify that the person on camera is real and matches the photo on their ID using advanced facial recognition.

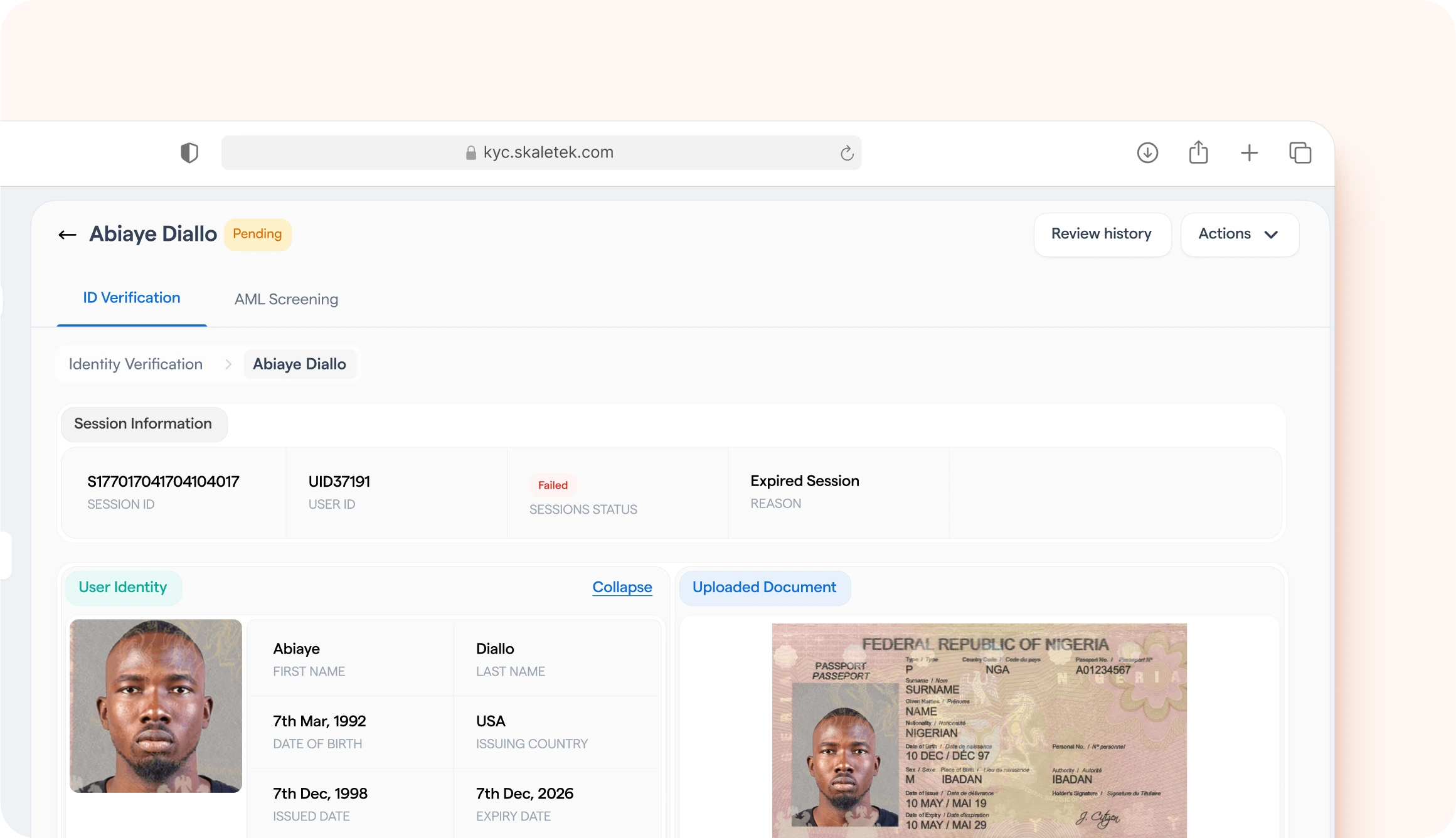

Step 3: Verify Individual

Confirm the identity against official government databases or NFC chip data for deeper validation.

Step 4: Due Diligence

Uncover hidden risks by layering in additional data sources and contextual checks for high-risk individuals.

Built for Global Compliance and Trust

AI Document Scanning Services

Automate identity checks with SKALETEK’s AI-powered scanning. Extract global ID data in milliseconds with high accuracy, detect forgeries, and assess image quality instantly.

Biometric Face Recognition Solution

Stop identity fraud with real-time biometric checks. Match users to their ID with a selfie and ensure they're physically present — not a photo, video, or mask.

Digital Document Verification

Instantly verify IDs with unmatched accuracy. Authenticate documents from 248 countries in milliseconds, match faces to IDs, detect tampering via digital signatures, and tap into government databases — all while staying fully compliant.

Seamlessly integrate SKALETEK into your tech stack.

Streamlined Verification for Smarter Compliance

Verify accounts, assess credit risk, detect duplicates, and validate addresses instantly—all with seamless, secure integration.

Bank Account Verification

Quickly match sort codes and account numbers for fast validation and fraud prevention.

Credit Checks

Unlock global credit risk insights with real-time bank data.

Duplicate Detection

Prevent fraud by ensuring each user has a unique profile across your platform.

Address Verification

Validate addresses in seconds with global address register access.