AI-Powered Fraud Detection. Instant. Accurate. Reliable.

Detect and prevent fraud in real time with advanced AI-driven monitoring. Eliminate manual reviews, reduce false positives, and stay compliant with evolving regulations—all seamlessly integrated into your system.

Smarter Fraud Detection, Stronger Protection

Stay ahead of evolving fraud with AI-powered precision. Reduce losses, enhance efficiency, and minimize false positives—all with a seamless, automated system.

25%

reduction in payment fraud losses

Stop fraudsters in their tracks with advanced ML-driven detection.

40%

boost in analyst efficiency

Equip teams with powerful tools to streamline fraud prevention.

70%

fewer false positives

Improve accuracy with intelligent rules and adaptive segmentation.

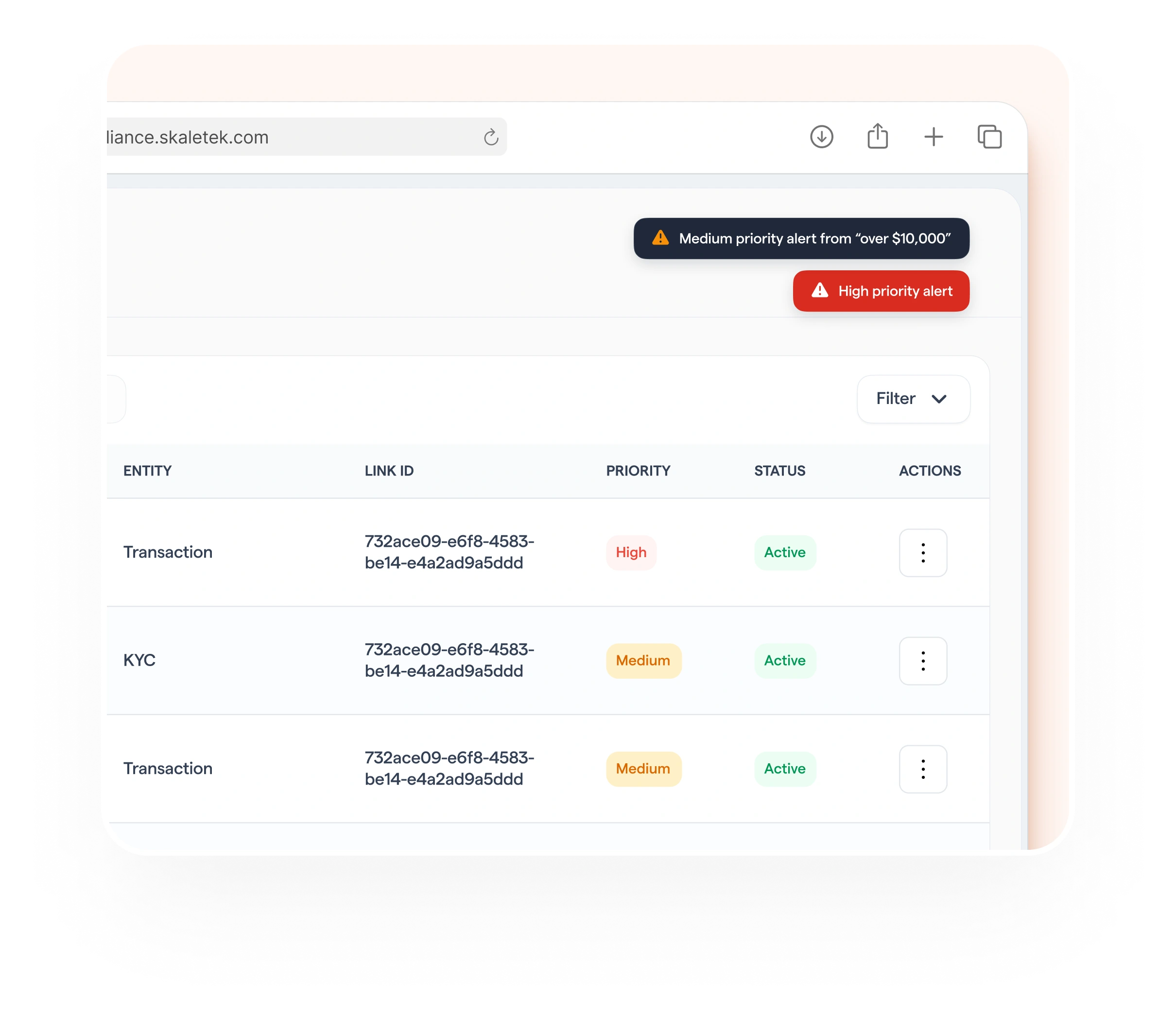

Our Fraud Detection in Action.

Skaletek provides fast, secure, and compliant KYC solutions. With AI-driven verification, biometric authentication, and real-time fraud detection, we streamline onboarding while ensuring regulatory compliance.

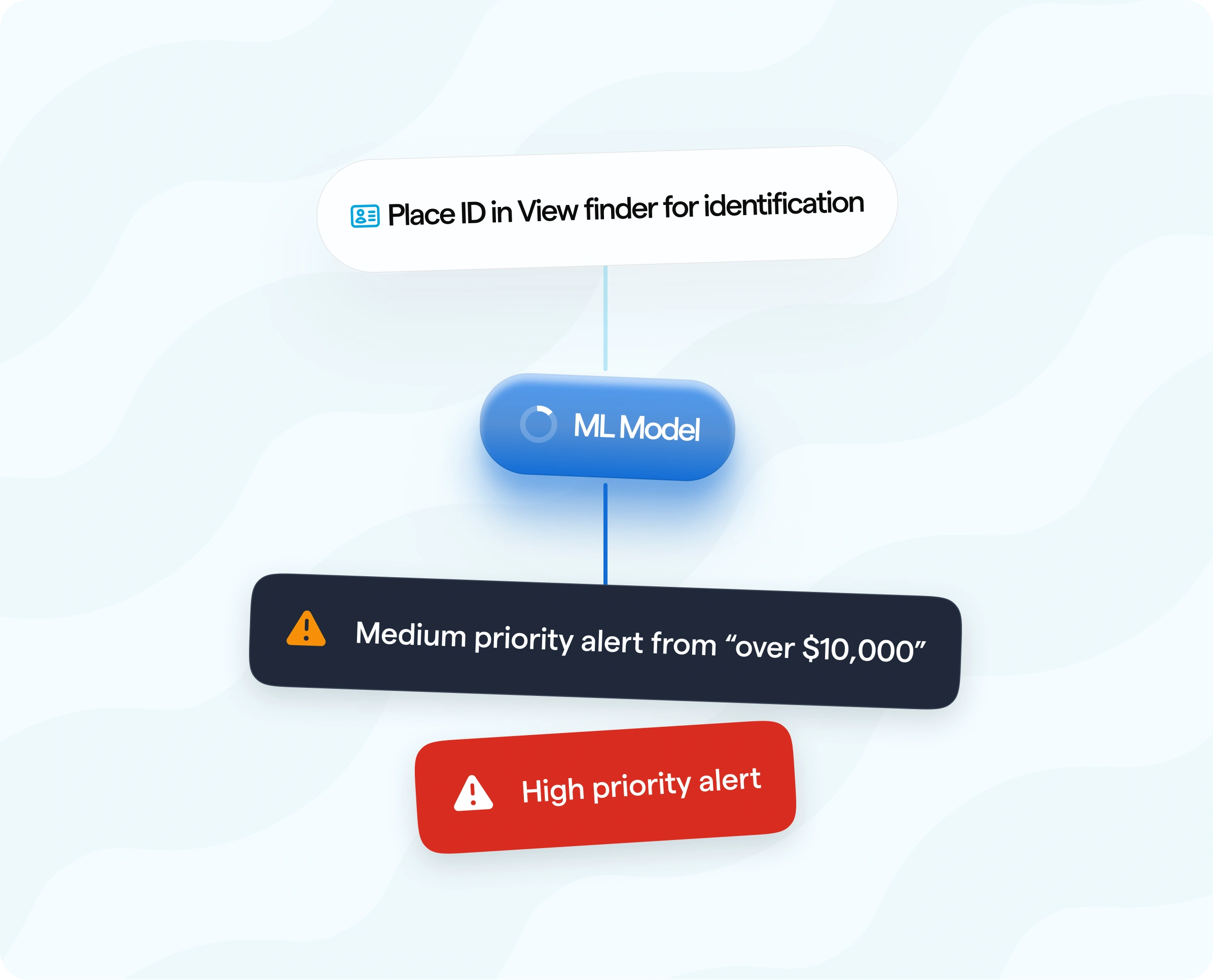

Strong AML Model

Dynamic Thresholds: Calibrates automatically and adapts to criminal behavior to beat fraudsters’ creativity.

Explainability: Not only detects fraud but also explains the reason why each alert was created.

Identity Clustering: Links accounts that may be controlled by a single individual or institution behind organized fraud.

Graph Network Detection: Tracks flow of illicit funds within your system.

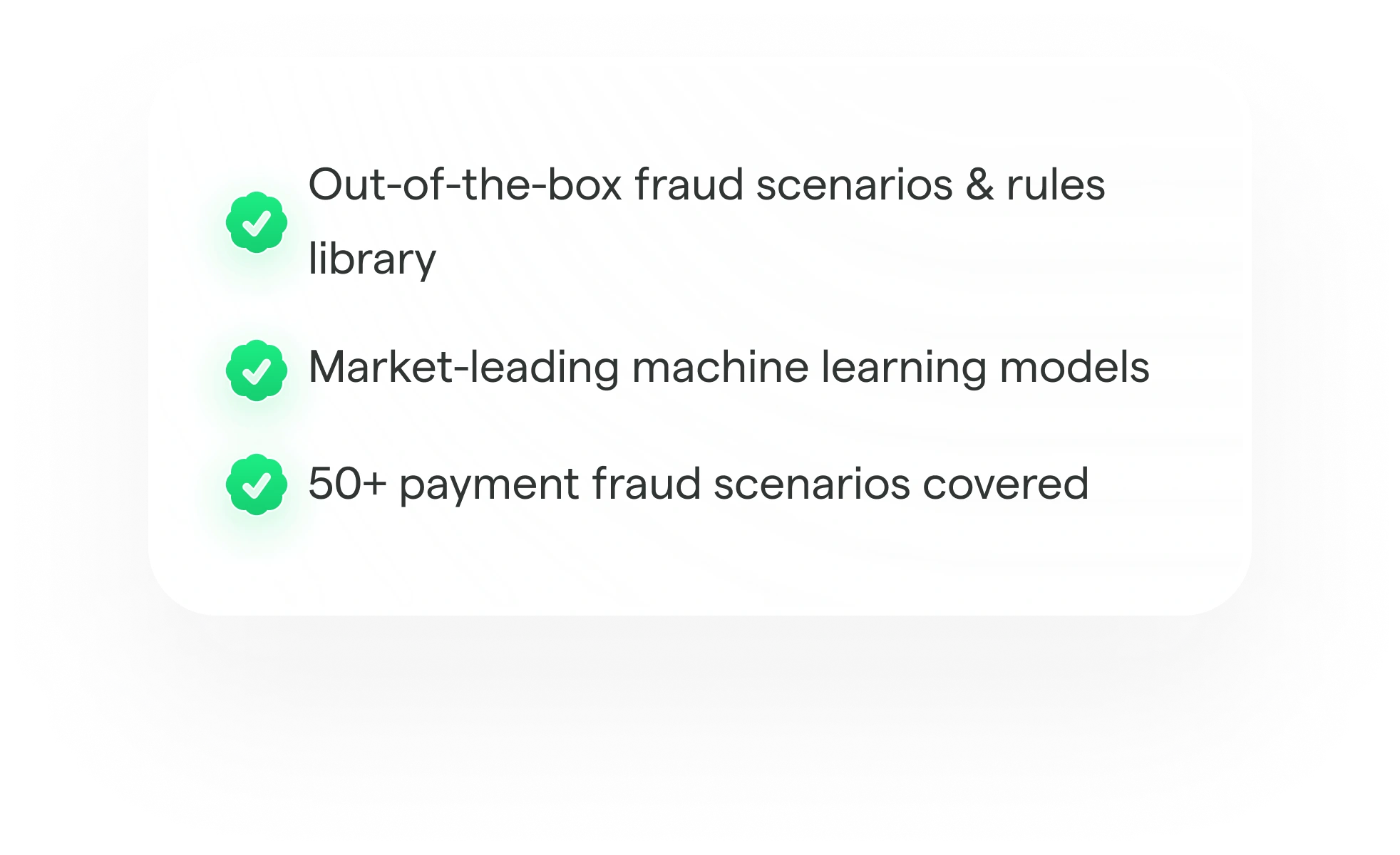

Unmatched speed to value

Go live in as little as two weeks through out-of-the-box capabilities & proven processes.

Detect fraud from day one with ML models trained on historical data.

Work with flexible data formats that will make data integration easy and fast.

Fraud scenarios covered across all payment rails

50+ payment type agnostic fraud scenarios covered.

Covers special scenarios for established payment rails including ACH, FedWire, Swift MT, and SEPA.

Emerging payment types supported with rich data like ISO 20022.

24x7x365 fraud detection for instant payment types like FedNow and Faster Payments.

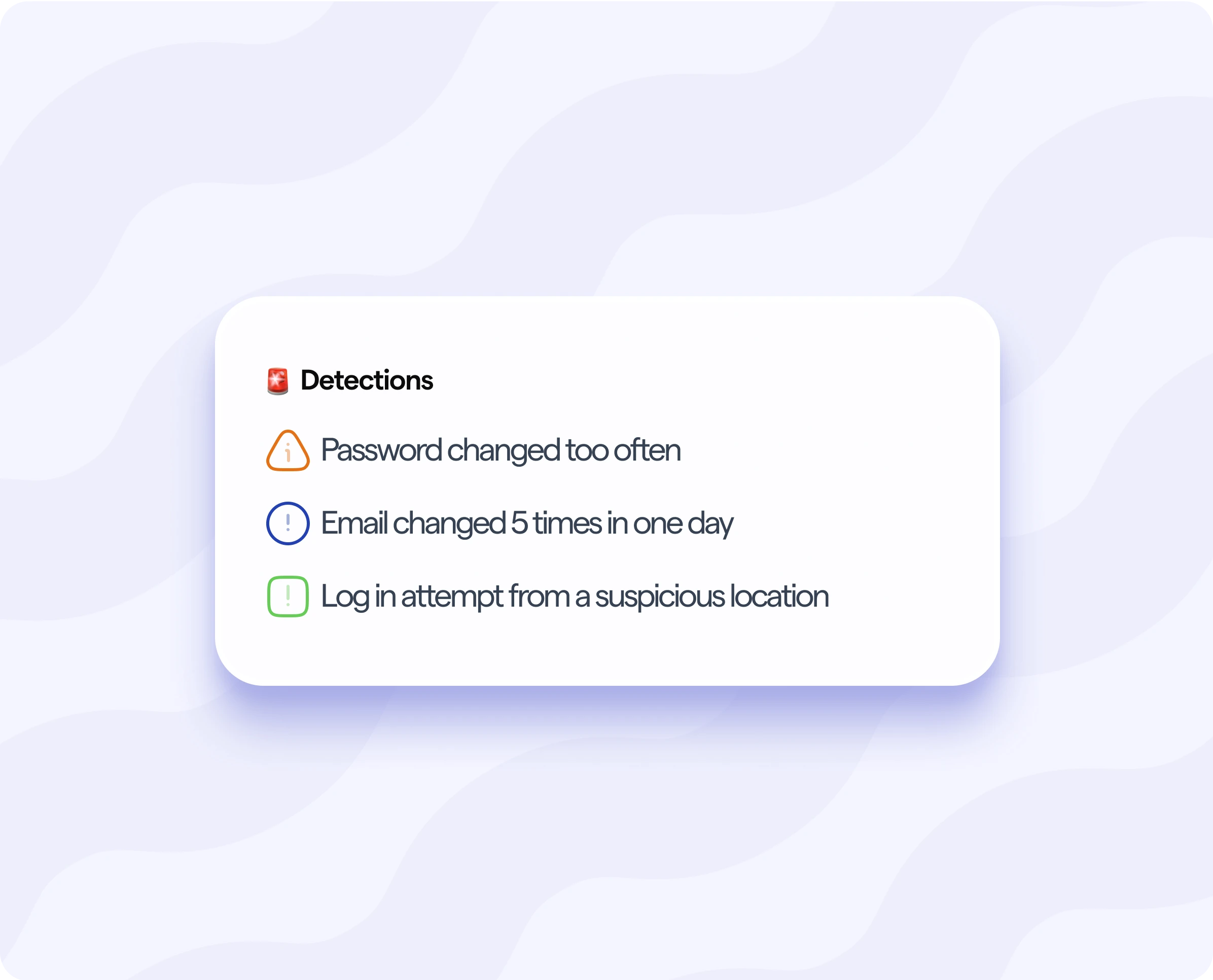

Detection starts pre-transaction with other events such as log-ins, profile changes.

Leader in Financial Crime Risk Data & Detection Technology

Insights you can’t get anywhere else: Derived from proprietary customer, company, and financial risk data.

First to connect & enrich multiple streams of disparate data: Adverse Media, Sanctions, PEPs, RCAs & UBOs.

Easy to use, unified fraud and AML management platform enhances decision making.

Deep domain knowledge across 1,000+ customers worldwide.

Seamlessly integrate SKALETEK into your tech stack.