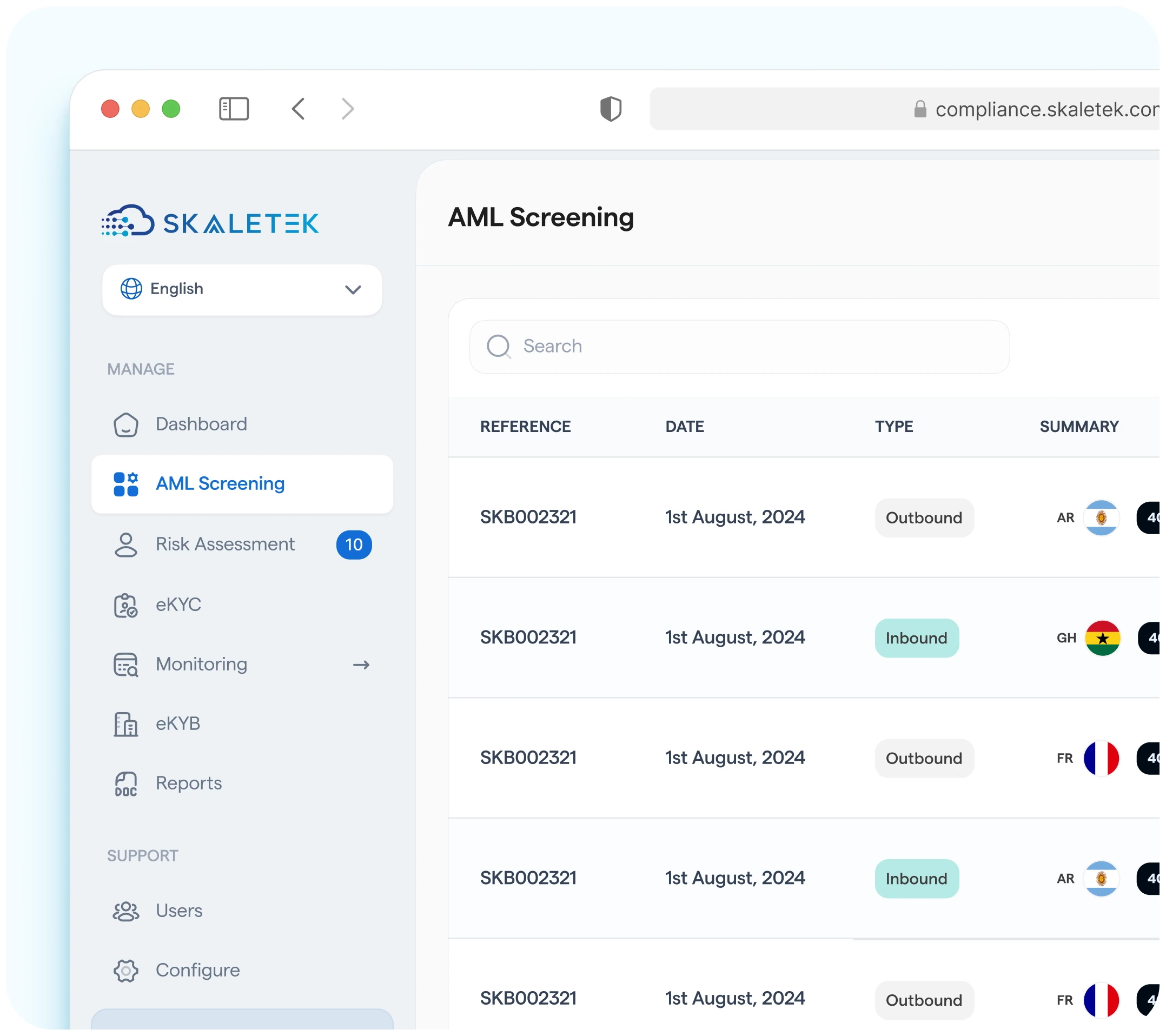

AML Screening & Onboarding Compliance

Streamline your customer onboarding process with AI-driven AML screening. Automatically identify and screen individuals, entities, and ultimate beneficial owners (UBOs) against global sanctions lists, PEPs, watchlists, and adverse media—ensuring compliance with anti-money laundering and counter-terrorist financing regulations while reducing the risk of penalties.

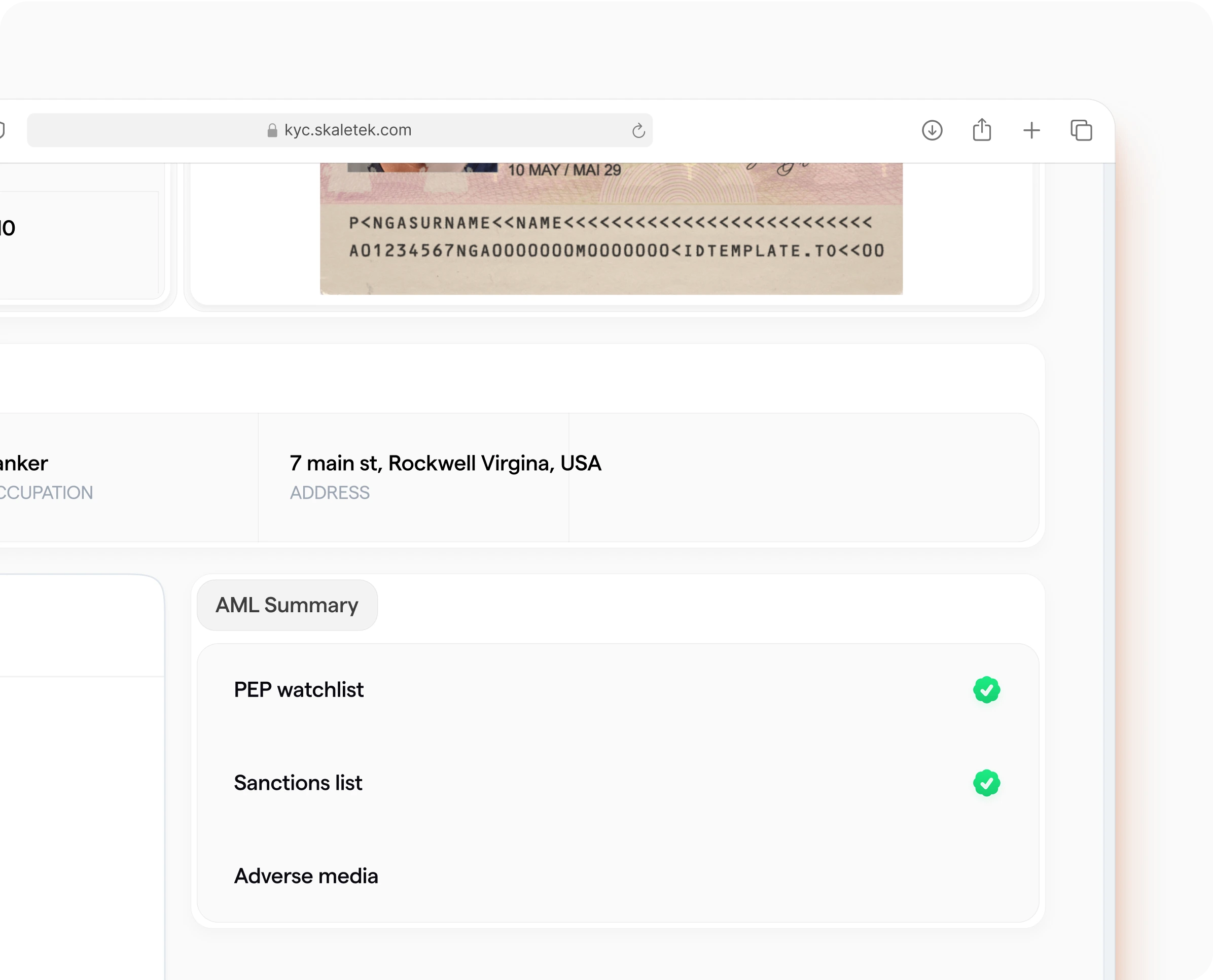

The Skaletek KYC Workflow

Stay compliant and in control with automated screening across global watchlists, PEPs, adverse media, and ongoing monitoring. Our AI-driven engine delivers accurate, always-on insights—so you can onboard faster, reduce risk, and meet regulatory demands with confidence.

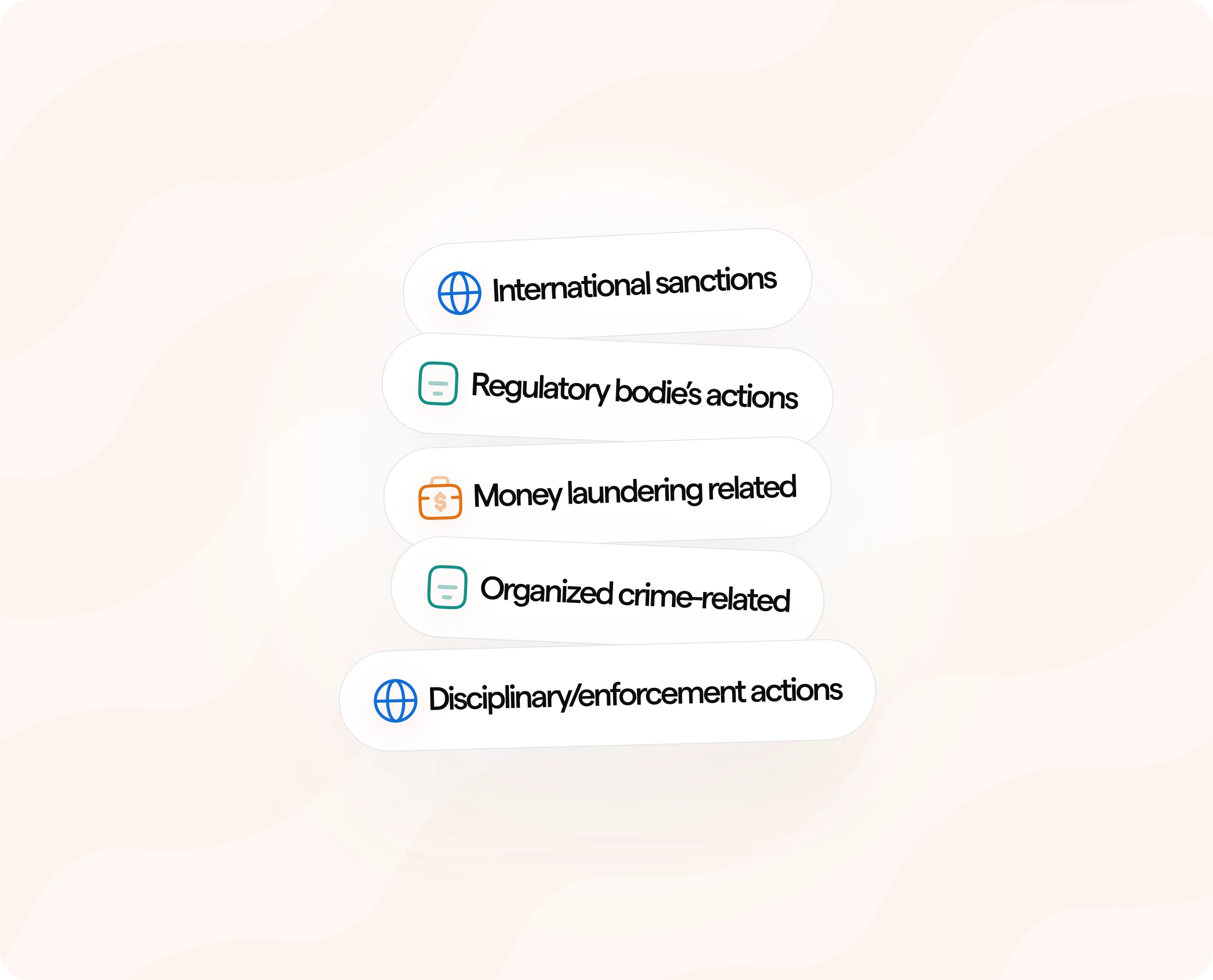

Monitored Lists

Instantly verify compliance with over 1,500 global sanctions, watchlists, and regulatory databases to stay ahead of risk.

PEPs

Identify Politically Exposed Persons from a global database of 1.7+ million records and assess risk with precision.

Adverse Media

Scan against the world’s largest adverse media archive, 3x bigger than the nearest competitor, for deeper risk insights.

Continuous Screening

Automate ongoing monitoring with real-time alerts, eliminating the need for manual rescreening and reducing compliance gaps.

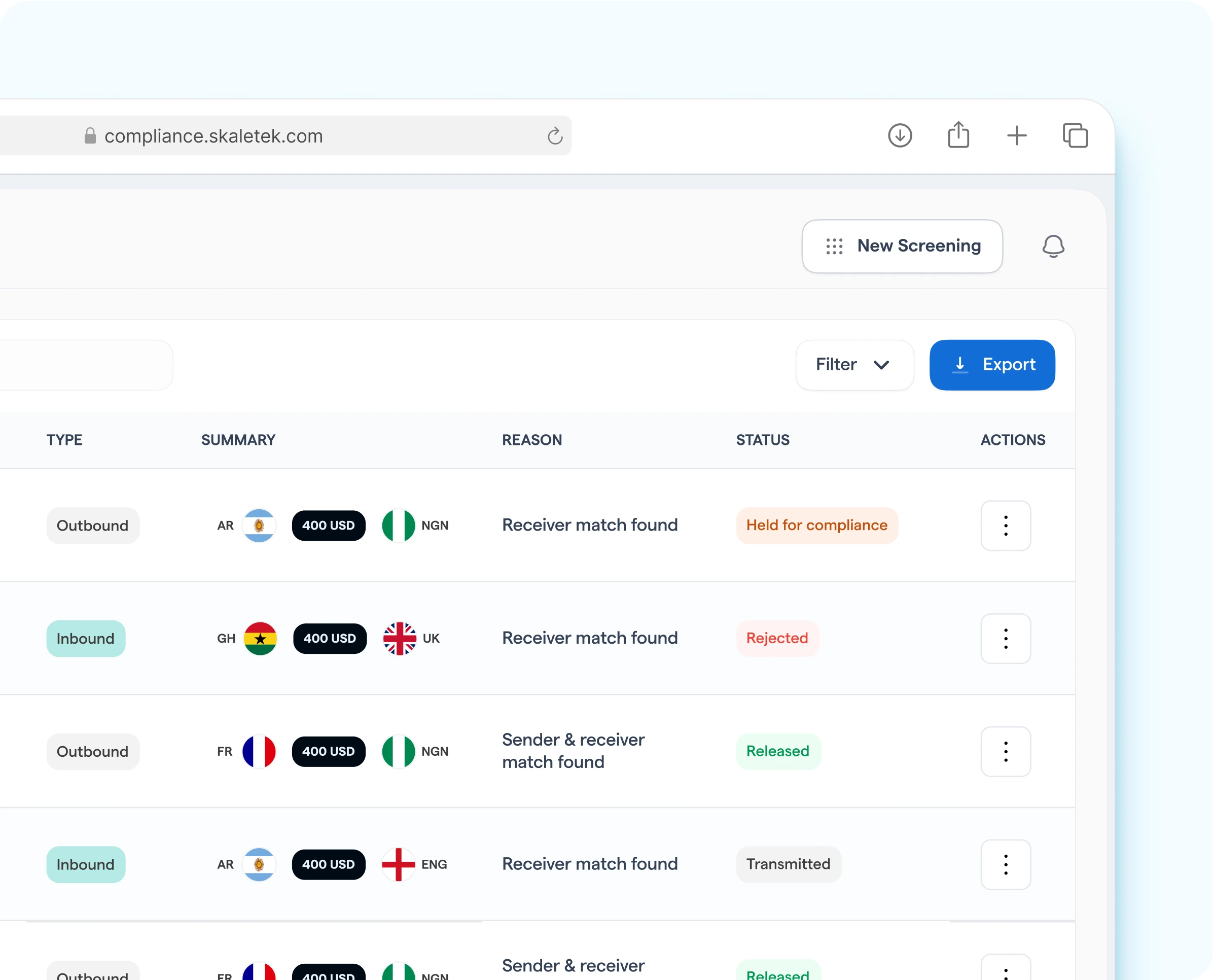

Global AML Screening

Protect your business from financial crime with automated screening against 900+ global sanctions, watchlists, and enforcement databases. Instantly identify high-risk individuals and entities—including those linked to money laundering, terrorism, fraud, and other illicit activities—so you can onboard with confidence and stay compliant.

High-risk monitored lists validation

SKALETEK validates identities against over 900 global high-risk lists, helping you stay compliant and reduce exposure to financial crime. These include international sanctions, regulatory enforcement actions, and lists related to money laundering, terrorism, human trafficking, organized crime, drug trafficking, fraud, debarments, fugitives, and disciplinary or law enforcement press releases.

PEP screening services

Our verification services cross-check against a global Politically Exposed Person list of over 1.7 million, including government officials, military and judicial figures, their families, associates, advisors, and state-owned enterprises.

Adverse media screening

As a leading adverse media screening provider, SKALETEK uncovers client or company involvement in financial crimes or reputational risks by screening over 3 billion deduplicated and prioritized media articles.

Automated ongoing AML (Anti-money laundering) solutions

Stay informed on legal and compliance changes with fully automated, continuous AML screening and monitoring services.

Seamlessly integrate SKALETEK into your tech stack.